We bring active, sophisticated and intelligent portfolio management to individuals and families. We believe that the difference between a ‘customer’ and a ‘client’ is the duration of the business relationship. Our goal is to maintain strong, long-term relationships with our clients during which we serve as an integral part of their current and future prosperity.

Utilizing both correlated and non-correlated asset classes, we provide each client with access to a wide variety of investment options, tailoring each individual solution to meet specific objectives. In addition, we pay special attention to after-tax returns and yields, working closely with our clients’ tax advisors.

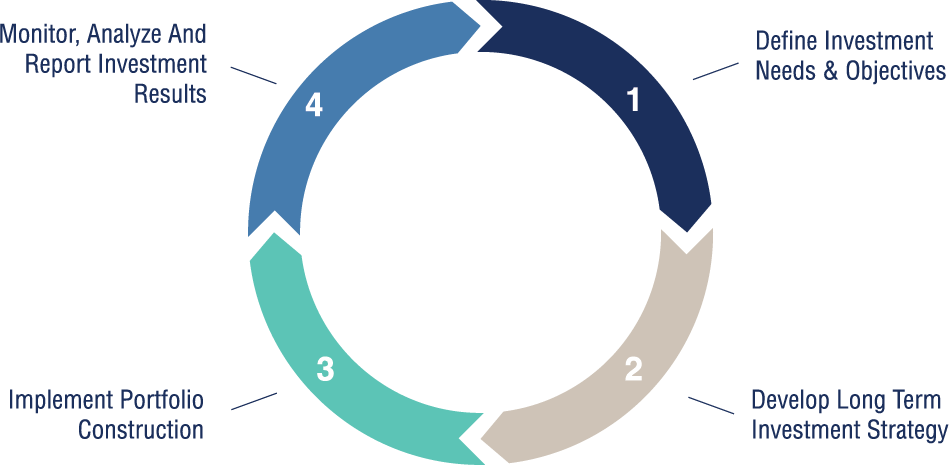

We work with our clients in a continuous and dynamic wealth management process as their goals and objectives evolve.

It starts with you: your goals, concerns, and preferences. Why take risks you don’t have to? Invest with purpose. We listen and formulate a plan, then consult with you as it’s implemented.

We monitor global economic trends and indicators to assess the growth prospects for multiple asset classes. We apply a disciplined asset allocation strategy that identifies asset classes with the potential to help you meet your goals—both for future returns, and the appropriate degree of volatility.

We intelligently and skillfully combine active and passive management, integrating passive investment vehicles (ETFs) to reduce fees and taxes but doing so with a dynamic approach. Our aim is to achieve the level of returns you need to meet your goals over time, while being mindful of your tax situation every year.

As your goals and objectives evolve over time, we’ll be sure this is reflected in your portfolio. And, even more importantly, we will be sure you understand the process and are as involved as you like.

Argyle Capital Partners offers a variety of products for our clients.